The 10 Best Home Care Agencies for Seniors in Dolton, IL for 2024

Dolton is a village in Cook County, approximately 25 minutes south of downtown Chicago. The 2020 Census found 13% of its 21,426 residents were in the 65+ age group, a time when people are more likely to need medical support. Fortunately, Dolton’s seniors aren’t far from excellent facilities, such as UChicago Medicine Ingalls Memorial Hospital and the Northwestern Memorial Hospital, which ranked in the country’s top 10 by U.S. News & World Report. There are many home care agencies as well, with their home health care equivalents also providing limited medical support. The average monthly fee for home care in Dolton is $4,957, which is about 4% and 10% more than the state and national averages, respectively.

Below we’ve compiled a comprehensive directory of every home care provider in the Dolton area – complete with services offered and reviews from families who’ve actually used the service. In addition to our in-depth provider listings, we’ve compiled resources to help seniors and their families to access all the tools they need to age in place safely and gracefully.

Home Care Agencies in Dolton, IL

28 Results

LoveBird HomeCare - Matteson, IL

4350 Lincoln Highway Suite 200, Matteson, IL, 60443

"We have set out to distinguish ourselves from other healthcare companies in the quality of our staff, the reliability of our screening proce..."

READ MOREParks Family Home Care - Mount Prospect, IL

1711 Forest Cove Drive Apt 212, Mount Prospect, IL, 60056

Andre Heavenly Homecare Agency - Country Club Hills, IL

4134 192nd Ct , Country Club Hills, IL, 60478

"Are you looking for a professional, dependable, affordable home healthcare agency, if so Andre Heavenly Homecare Agency (AHHA) is what you’r..."

READ MOREWhat you can do with Caring

Paying for Home Care in Dolton, IL

The Cost of Home Care in Dolton, IL

According to the 2020 Genworth Cost of Care Survey, a senior in Dolton budgeting for home care should expect to pay around $4,957 per month. This is about $190 more than the typical fee paid in Illinois and $476 more than the national average. It’s also the highest fee in the region. For example, in Rockford, fees average at $4,872. In Bloomington, they’re $4,862, and they are $4,767 in Kankakee.

Dolton

$4,957

Illinois

$4,767

The United States

$4,481

Rockford

$4,872

Kankakee

$4,767

Bloomington

$4,862

The Cost of Home Care vs. Other Senior Care Options in Dolton, IL

The provision of medical support by home health care agencies in Dolton adds another $96 per month to the average home care fee of $4,957. Seniors who can attend adult day centers can get care for around $1,614 while those better served by assisted living facilities can expect to pay $4,950 for accommodation and care. Seniors who need 24/7 care from medical professionals will need to budget for $8,076, which is the average fee for a semiprivate room in a nursing home.

Home Care

$4,957

Home Health Care

$5,053

Adult Day Health

$1,614

Assisted Living

$4,950

Nursing Home Care (semi-private room)

$8,076

Note: Data for Dolton was unavailable, so data for the nearest city, Chicago, was used instead.

Financial Assistance for Home Care in Dolton, IL

Given the high cost of in-home care, many people use one or more forms of financial assistance to cover the expenses. Below, we explain some of the most common sources of financial help for paying for in-home care. If none of these options are available to you, you can reach out to your Area Agency on Aging or Aging and Disability Resource Center to learn about local resources.

Long-Term Care Insurance: Long-Term Care Insurance covers expenses related to senior care, including in-home care. Depending on the policy type, beneficiaries may receive a cash payment to use towards long-term care or reimbursement for qualifying long-term care expenses. Note that there are limitations- typically a maximum benefit of $150 per day- and exact coverage terms vary depending on the exact policy, so always check the details.

Medicare: Medicare does not cover in-home care because it is classified as custodial, or non-medical, care. However, some Medicare Advantage and Medicare Supplement plans, which offer expanded benefits, may cover in-home custodial care.

Medicaid: Medicaid coverage of in-home care varies between different states because it is not a federally mandated benefit. Currently, all states cover some in-home care either through their standard Medicaid or a waiver program. The specific coverage rules are set individually by each state.

Veterans’ Benefits: The Aid and Attendance benefit is a monthly cash payment that beneficiaries can use to pay for senior care, including in-home care services. To qualify for A&A, Veterans must already receive the VA pension and meet several additional requirements, including needing assistance with the activities of daily living.Contact the Department of Veterans Affairs to learn more.

Reverse Mortgages: Home Equity Conversion Mortgages (HECMs) are federally insured loans that are available to homeowners age 62 and over. Reverse mortgages allow you to access a portion of your home’s equity in cash, tax free. Many seniors use reverse mortgages to finance their care expenses, including in-home care. Note that although there are no monthly payments due on reverse mortgage loans, borrowers do have to repay the loan once the last surviving homeowner passes away, moves, or sells the home.

Free & Low-Cost Home Care Resources in Dolton, IL

Dolton’s wealth of free and low-cost resources can help seniors continue to remain at home as they age. These resources can reduce seniors’ tax burdens, ensure they get good quality meals every day and reduce the costs of heating their homes in winter and cooling them in summer.

| Resource | Contact | Service |

|---|---|---|

| Home Weatherization Program | (217) 785-2533 | The Illinois Department of Commerce & Economic Opportunity's Home Weatherization Program helps low-income seniors whose homes have become energy inefficient. For successful applicants, the program can cover the costs of insulating walls, attics and crawl spaces, in addition to repairing or replacing the causes of heat leakage, such as damaged doors or windows. To be eligible, the total income for the household must be no more than 150% of the federal poverty level when state funds are used to finance the project. |

| Senior Citizen Homestead Exemption | (312) 443-5100 | Cook County seniors who own and live in their own homes in Dolton are entitled to apply for the Senior Citizen Homestead Exemption. On average, this can save them $300 every year on their property taxes, rising to around $750 if it's combined with the Homestead Exemption. Seniors may also apply to have the assessed value of their properties frozen, which can, over time, result in minimal increases or decreases in taxes based on changes in the value of surrounding properties. |

| Meals on Wheels | (630) 294-5698 | Operating from Dolton Community Cafe, the Meals on Wheels program delivers freshly prepared and nutritionally balanced meals to seniors in the village. To qualify, applicants must be homebound and unable to prepare meals themselves or have someone who can help. Each meal contains protein and vegetables, as well as fruits, grains and milk. |

| Low Income Home Energy Assistance Program (LIHEAP) | (800) 571-2332 | LIHEAP is a state-sponsored program that can help seniors on low incomes who struggle to pay their utility bills. The program can provide financial assistance for water and sewage bills, rent arrears, mortgage payments and home-fuel costs, such as electricity, gas, propane and wood. LIHEAP can only provide a one-time payment but can help the senior develop an affordable budget for subsequent utility expenses. |

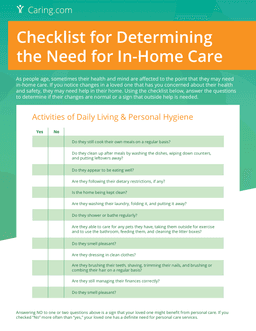

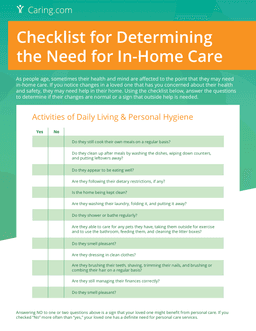

Determining Your Loved One’s Need for In-Home Care

Aging can be a difficult process, and loved ones may not always ask for help – oftentimes it’s up to their family to evaluate their need for help around the house. While no two situations are exactly alike, this checklist can help you and your loved ones determine when it’s time to start the search for a home care provider.

Guidelines for Talking About In-Home Care

If you’ve determined that your loved one needs the assistance of a care provider in their home, it may be time for a difficult conversation. Handled correctly, however, this process can bring a family together and ensure that everyone’s concerns are addressed. Use this PDF as a starting point to help the conversation stay as positive and productive as possible.